FXGT Account Types: Choosing the Right Trading Account

Best Global Trading Conditions 2024

⭐⭐⭐⭐⭐

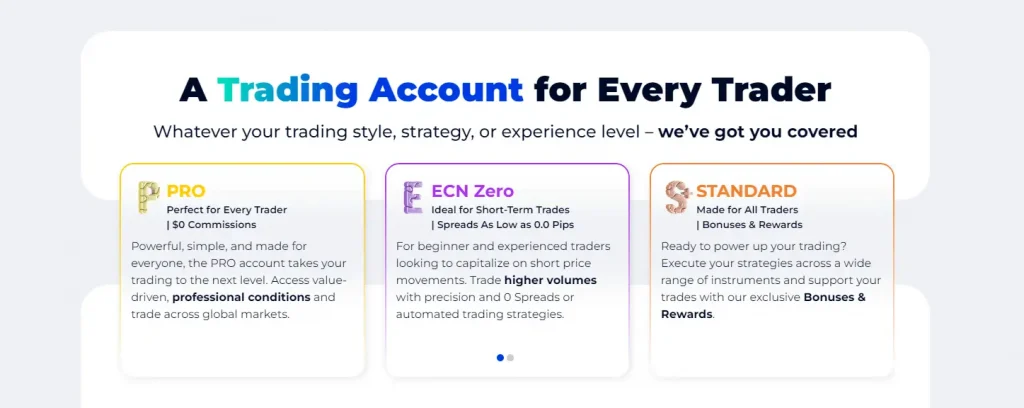

FXGT offers four main account types to cater to different trading needs:

- Mini Account

- Standard+ Account

- PRO Account

- ECN Account

Each account type has unique features, trading conditions, and target users.

Comparison Table of FXGT Account Types

| Feature | Mini | Standard+ | PRO | ECN |

| Minimum Deposit | $5 | $5 | $5 | $5 |

| Spreads From | 10 points | 10 points | 5 points | 0 points |

| Commission | $0 | $0 | $0 | Up to $6 per lot |

| Leverage | Up to 1:1000 | Up to 1:1000 | Up to 1:1000 | Up to 1:1000 |

| Instruments | Limited | Full Range | Full Range | Full Range |

| Promotions | Yes | Yes | No | No |

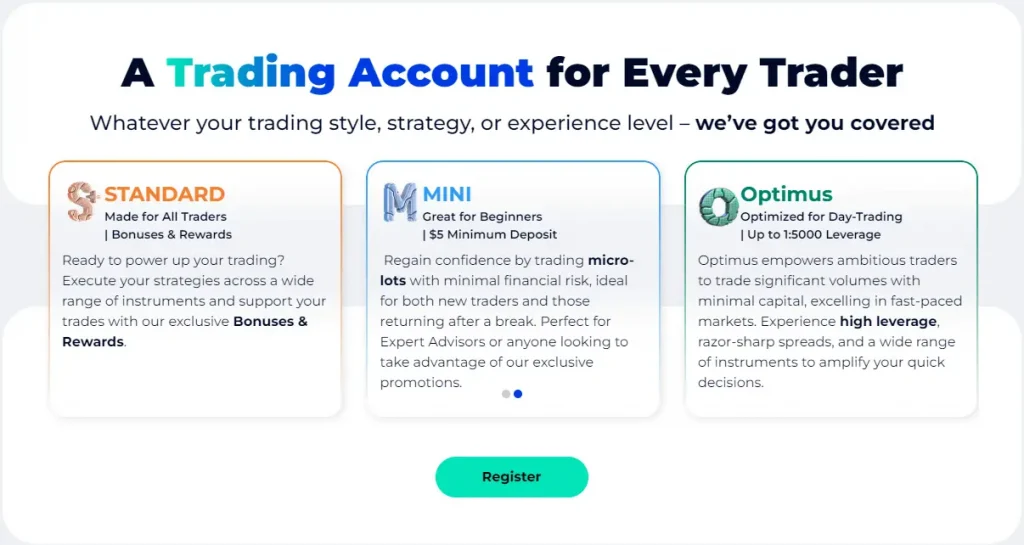

Standard+ Account

The Standard+ Account offers a balance between accessibility and advanced features.

Key features:

- $5 minimum deposit

- No commissions

- Spreads from 10 points

- Full range of trading instruments

- Access to promotions and bonuses

Suitable for:

- Intermediate traders

- Those seeking a balance of cost and features

- Traders interested in a wide range of assets

Mini Account

The Mini Account is designed for beginners and traders with limited capital.

Key features:

- Low minimum deposit: $5

- Commission-free trading

- Spreads from 10 points

- Access to major trading instruments

- Eligible for promotions and bonuses

Suitable for:

- New traders

- Those testing strategies

- Traders with small capital

PRO Account

The PRO Account caters to experienced traders seeking advanced conditions.

Key features:

- $5 minimum deposit

- No commissions

- Tighter spreads from 5 points

- Full range of trading instruments

- No promotions or bonuses

Suitable for:

- Professional traders

- High-volume traders

- Those prioritizing tight spreads over bonuses

ECN Account

The ECN Account offers direct market access with raw spreads.

Key features:

- $5 minimum deposit

- Commission up to $6 per lot

- Raw spreads from 0 points

- Full range of trading instruments

- No promotions or bonuses

Suitable for:

- Expert traders

- Scalpers and high-frequency traders

- Those seeking the tightest spreads possible

Leverage Options

FXGT offers leverage up to 1:1000 across all account types. Leverage levels vary based on:

- Instrument traded

- Account equity

- Regulatory restrictions

Account Currencies

FXGT supports multiple account currencies:

- USD (US Dollar)

- EUR (Euro)

- GBP (British Pound)

- JPY (Japanese Yen)

- BTC (Bitcoin)

- ETH (Ethereum)

- USDT (Tether)

Table: Maximum Leverage by Instrument Type

Instrument | Maximum Leverage |

Major Forex Pairs | 1:1000 |

Minor Forex Pairs | 1:500 |

Cryptocurrencies | 1:20 |

Indices | 1:200 |

Commodities | 1:100 |

Trading Platforms

All FXGT account types offer access to:

- MetaTrader 5 (MT5)

- Desktop version

- WebTrader

- Mobile apps (iOS and Android)

- MetaTrader 4 (MT4)

- Desktop version

- WebTrader

- Mobile apps (iOS and Android)

Margin Requirements

Margin requirements differ based on account type and instrument:

- Mini and Standard+: Higher margin requirements

- PRO and ECN: Lower margin requirements for certain instruments

Formula: Margin = (Lot Size * Contract Size * Price) / Leverage

Swap Rates and Overnight Fees

Swap rates apply to positions held overnight:

- Rates vary by instrument and direction (long/short)

- PRO and ECN accounts may have lower swap rates

- Swap-free (Islamic) accounts available upon request

Deposit and Withdrawal Methods

Available payment options for all account types:

- Bank Wire Transfer

- Credit/Debit Cards

- E-wallets (Skrill, Neteller)

- Cryptocurrencies (Bitcoin, Ethereum)

Processing times and fees may vary by method and account type.

Account Opening Process

Steps to open an FXGT account:

- Visit the FXGT website

- Click “Open Account”

- Choose account type

- Fill in personal information

- Upload verification documents

- Await approval (typically 1-2 business days)

- Fund account and start trading

Account Upgrades and Downgrades

Traders can switch between account types:

- Log in to the client portal

- Navigate to “Account Management”

- Select “Change Account Type”

- Choose desired account type

- Confirm changes

Note: Changing account types may affect open positions and bonuses.

Demo Accounts

FXGT offers demo accounts for all account types:

- Practice with virtual funds

- Test strategies risk-free

- Familiarize with trading platforms

- No time limit on demo usage

Islamic (Swap-Free) Accounts

FXGT provides swap-free accounts for Islamic traders:

- Available for all account types

- No overnight fees charged

- May have different spreads or commissions

- Requires proof of Islamic faith

Multi-Account Manager (MAM)

FXGT supports MAM functionality for money managers:

- Manage multiple client accounts

- Allocate trades proportionally

- Customize client permissions

- Available for PRO and ECN accounts

Account Security Features

FXGT implements security measures across all account types:

- Two-factor authentication (2FA)

- SSL encryption for data transmission

- Segregated client funds

- Regular security audits

Corporate Accounts

FXGT offers corporate accounts for business entities:

- Tailored solutions for companies

- Higher withdrawal and deposit limits

- Dedicated account manager

- Custom trading conditions available

Contact FXGT directly for corporate account inquiries.

VIP Account Status

High-volume traders may qualify for VIP status:

- Lower spreads

- Higher leverage options

- Priority customer support

- Exclusive market analysis

- Personalized account management

Criteria for VIP status varies; contact FXGT for details.

Educational Resources

FXGT provides educational materials for all account holders:

- Video tutorials

- Trading guides

- Webinars

- Market analysis

- Economic calendar

Access may vary by account type.

Customer Support

All FXGT account types receive customer support:

- 24/5 support via email and live chat

- Multilingual support team

- Dedicated phone support for VIP accounts

Account Inactivity Policy

FXGT may apply inactivity fees:

- Accounts inactive for 90 days may incur fees

- Fee amount varies by account type

- Reactivation possible by placing a trade or depositing funds

Regulatory Compliance

FXGT accounts comply with regulatory requirements:

- KYC (Know Your Customer) procedures

- AML (Anti-Money Laundering) policies

- Negative balance protection

- Risk disclaimers provided

FAQ: Preguntas Frecuentes

How do I choose the right FXGT account type for my trading needs?

To select the appropriate account type:

- Assess your trading experience level

- Consider your typical trade volume

- Evaluate your preference for tight spreads vs. bonuses

- Review the minimum deposit requirements

- Compare the available instruments for each account type

- If unsure, start with a demo account to test different types

Contact FXGT support for personalized advice on account selection.

Can I change my account type after opening an FXGT account?

Yes, you can change your account type:

- Log in to your FXGT client portal

- Navigate to “Account Management”

- Select “Change Account Type”

- Choose your desired new account type

- Review and accept any changes in trading conditions

- Submit your request for approval

Note that changing account types may affect open positions and active bonuses. Contact support if you need assistance with the process.

What should I do if I experience technical issues with my FXGT trading account?

If you encounter technical problems:

- Check your internet connection

- Verify your login credentials

- Clear your browser cache or restart the trading platform

- Check FXGT’s system status page for any known issues

- If problems persist, contact technical support at [email protected]

- Provide detailed information about the issue, including screenshots if possible

- Follow the support team’s instructions for troubleshooting