Understanding RCI in Malaysian Market Context

The Rank Correlation Index (RCI) serves as a vital technical indicator for Malaysian traders, particularly in analyzing market momentum and trend reversals. In the dynamic Malaysian forex market, where the ringgit (MYR) exhibits unique patterns influenced by regional economic factors, RCI provides valuable insights for both novice and experienced traders.

Key Market Characteristics:

• Bank Negara Malaysia policies

• Regional trade flows

• Palm oil export impact

• Manufacturing sector influence

• Foreign investment patterns

• ASEAN market correlations

• Local market regulations

The Malaysian trading environment presents distinct opportunities for implementing RCI strategies, particularly during Asian trading hours when local market factors have the strongest impact.

Add Your Heading Text Here

| Time (MYT) | Market Activity | Liquidity Level |

| 07:00-10:00 | Asian Core | Very High |

| 15:00-18:00 | European Overlap | High |

| 21:00-24:00 | US Session | Moderate |

Risk Management Framework

| Account Size (MYR) | Risk per Trade | Position Size |

| 20,000 | 1% | 0.1 lot |

| 50,000 | 1.5% | 0.2 lot |

| 100,000 | 2% | 0.3 lot |

Advanced MT5 RCI Implementation Strategies

| Strategy Type | Stop Loss | Take Profit | Holding Period |

| Scalping | 15-20 pips | 1:1.3 | 10-30 minutes |

| Intraday | 25-35 pips | 1:1.8 | 2-6 hours |

| Position | 45-60 pips | 1:2.5 | 1-3 days |

Market Analysis Components:

• Technical price patterns

• Volume analysis

• Support/resistance levels

• Trend strength indicators

• Momentum confirmation

• Market sentiment analysis

• Economic calendar events

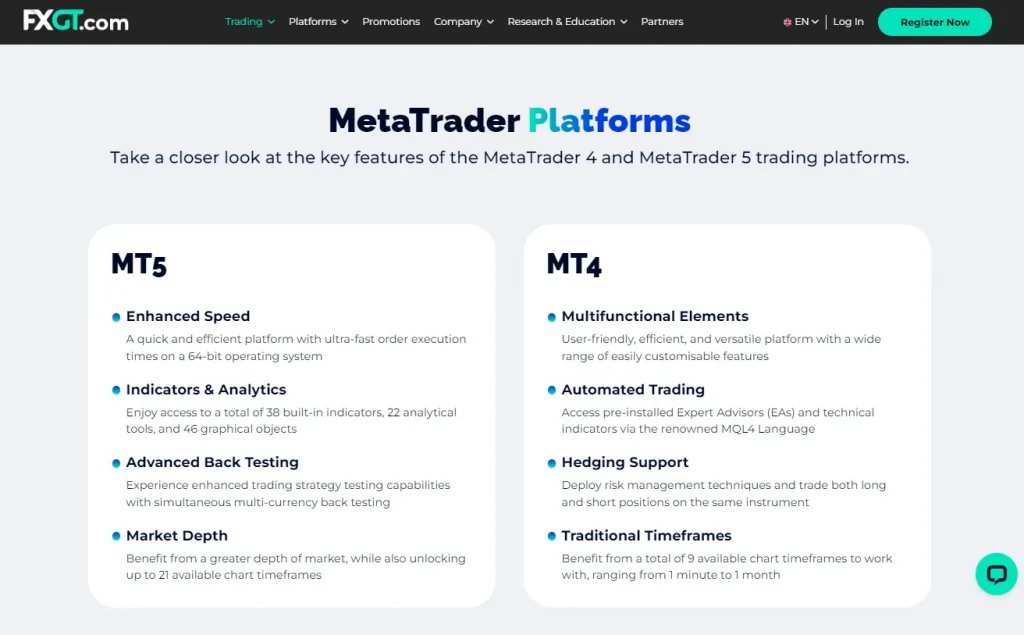

MT5 RCI Configuration for Malaysian Markets

When setting up RCI on MT5 platforms for Malaysian trading conditions, consider these essential parameters:

Basic RCI Settings:

- Primary timeframe: 9 periods

- Secondary timeframe: 26 periods

- Long-term analysis: 52 periods

- Signal line parameters: ±80 levels

- Chart overlay options

- Color coding preferences

- Alert configurations

The effectiveness of MT5 RCI in Malaysian markets often depends on proper calibration to local market conditions, particularly during key economic events affecting the ringgit.

Conclusion

The implementation of MT5 RCI in Malaysian forex trading requires a thorough understanding of both technical analysis and local market dynamics. Success comes from properly calibrating the indicator to Malaysian market conditions while maintaining strict risk management protocols.

Key takeaways include:

• MT5 RCI provides valuable insights for Malaysian market analysis

• Proper parameter settings are crucial for effective implementation

• Risk management must be adapted to local market conditions

• Combining RCI with other indicators enhances trading accuracy

• Understanding local market timing improves trading results

Malaysian traders can significantly improve their trading outcomes by mastering MT5 RCI implementation while remaining mindful of local market characteristics and risk management principles.

FAQ

How does MT5 RCI differ from traditional RSI for Malaysian traders?

MT5 RCI focuses on price rank correlation rather than relative strength, making it more suitable for Malaysian market conditions where price movements can be influenced by regional factors.

What are the optimal RCI settings for trading MYR pairs?

For Malaysian currency pairs, the recommended settings are 9 periods for short-term, 26 for medium-term, and 52 for long-term analysis, with adjustments based on specific pair volatility.

Can MT5 RCI be effectively combined with other indicators?

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

How reliable is RCI for day trading in Malaysian markets?

RCI shows high reliability during Asian trading sessions when Malaysian market factors have the strongest influence, particularly between 07:00-10:00 MYT.

What's the best way to avoid false signals when using MT5 RCI?

Combine RCI with volume analysis and key support/resistance levels, and always confirm signals with multiple timeframe analysis.