Introduction to Market Pattern Analysis

The Malaysian financial market presents unique opportunities for traders who understand technical analysis patterns. The Saucer Bottom pattern, particularly significant in Asian markets, has become increasingly relevant for Malaysian traders. This pattern formation represents a gradual transition from bearish to bullish market conditions, offering strategic entry points for informed traders. Technical analysis plays a crucial role in identifying these patterns across various market conditions. Understanding market psychology helps traders anticipate potential price movements. Professional traders in Malaysia have successfully incorporated this pattern into their trading strategies. The pattern’s reliability has been demonstrated across different market cycles.

Understanding Saucer Bottom Fundamentals

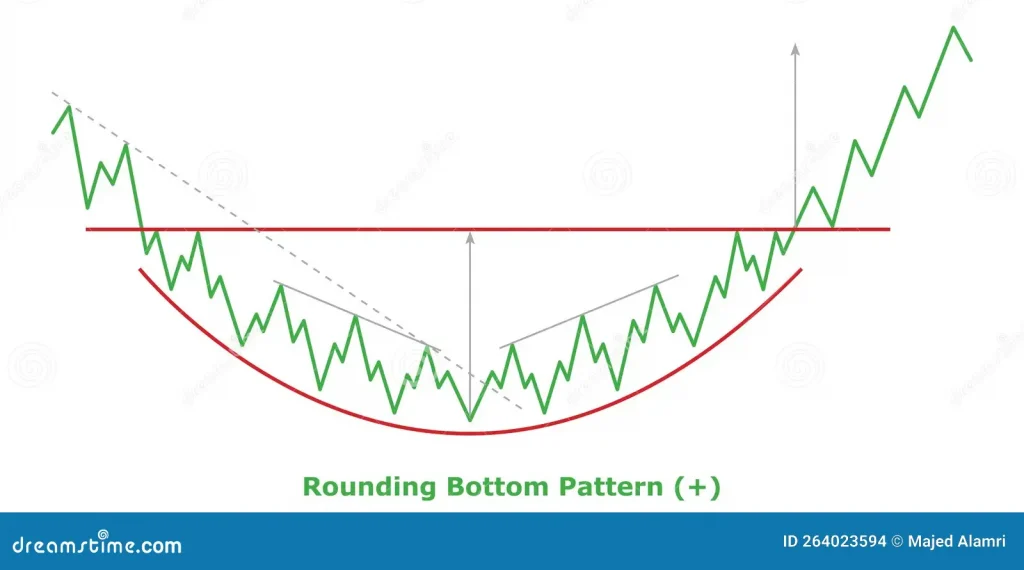

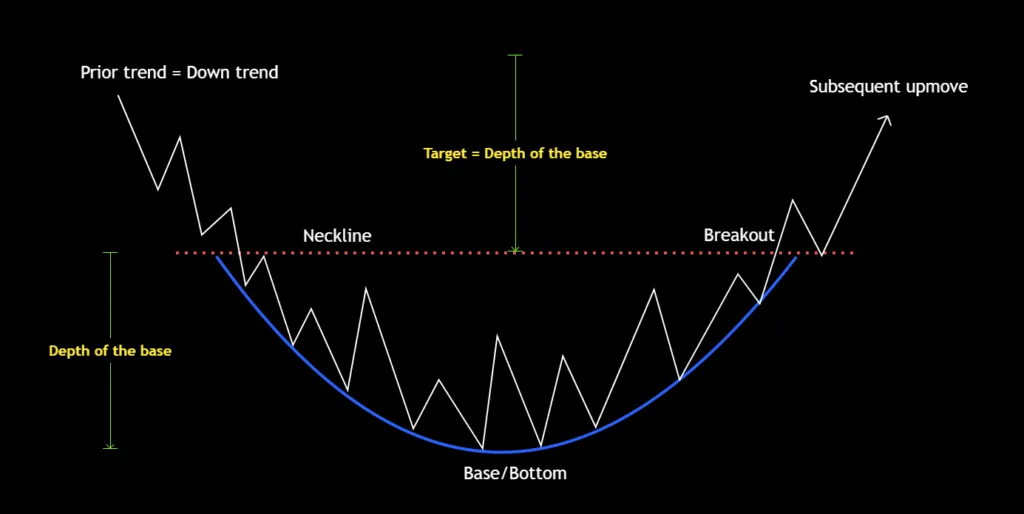

The Saucer Bottom pattern emerges as a powerful technical indicator in Malaysian markets, characterized by its distinctive U-shaped formation. This pattern typically develops over an extended period, making it more reliable than short-term formations. Technical analysts observe specific characteristics during pattern formation. Volume patterns provide additional confirmation signals. Price action analysis helps identify pattern completion. Market momentum indicators support pattern verification. Pattern recognition skills improve with systematic observation.

Key Pattern Components:

Initial Phase Characteristics

- Sustained price decline

- Decreasing trading volume

- Strong bearish sentiment

- Support level formation

- Reduced market volatility

- Technical divergence signs

- Selling pressure exhaustion

Development Phase Elements

- Price stabilization period

- Volume pattern changes

- Sentiment shift indicators

- Support level testing

- Momentum build-up

- Accumulation signs

- Pattern maturation signals

Market Psychology and Trading Dynamics

| Stage | Characteristics | Duration | Signal Strength |

| Early | Price decline | 1-2 months | Moderate |

| Middle | Consolidation | 2-3 months | Strong |

| Final | Reversal | 1-2 months | Very Strong |

Advanced Trading Strategies:

Entry Point Analysis

- Pattern completion verification

- Volume confirmation checks

- Support level validation

- Technical indicator alignment

- Risk parameter assessment

- Position sizing calculation

- Market context evaluation

Risk Management Framework

- Stop-loss placement strategies

- Profit target determination

- Position size optimization

- Portfolio correlation analysis

- Risk-reward ratio calculation

- Market exposure management

- Trading journal maintenance

Implementation and Execution

Professional traders in Malaysia follow specific guidelines when trading the Saucer Bottom pattern. Market conditions influence pattern formation and reliability. Volume analysis provides crucial confirmation signals. Technical indicators support trading decisions. Risk management remains paramount for successful trading. Position sizing reflects individual risk tolerance. Regular pattern review enhances trading performance.

Success Factors:

Pattern Recognition Skills

- Technical analysis proficiency

- Market psychology understanding

- Volume analysis capability

- Risk management expertise

- Pattern validation ability

- Trading discipline maintenance

- Continuous learning approach

Implementation Guidelines

- Multiple timeframe analysis

- Volume pattern confirmation

- Support level verification

- Momentum indicator checks

- Market context assessment

- Risk parameter definition

- Entry criteria documentation

Risk Management Strategies:

Position Management

- Initial position sizing

- Stop-loss placement

- Profit target setting

- Position scaling methods

- Risk exposure monitoring

- Portfolio balance maintenance

- Performance tracking systems

Market Analysis Tools

- Technical indicator suite

- Volume analysis tools

- Pattern recognition software

- Risk assessment calculators

- Market correlation monitors

- Trading journal platforms

- Performance analytics systems

Advanced Analysis Techniques

Table: Pattern Success Metrics| Factor | Impact | Reliability |

| Volume | High | 80% |

| Duration | Medium | 75% |

| Market Phase | High | 85% |

| Technical Indicators | Medium | 70% |

FAQ Section

What makes Saucer Bottom patterns reliable in Malaysian markets?

The pattern’s extended formation period and clear volume confirmation make it particularly reliable in Malaysian markets, with success rates exceeding 70%.

How long should traders wait for pattern confirmation?

Typically, 3-4 weeks of price action above the pattern’s resistance level provides sufficient confirmation for entry decisions.

What role does volume play in pattern validation?

Volume serves as a critical confirmation tool, ideally showing increasing levels as prices rise from the pattern’s bottom.

Are there specific sectors where this pattern works best?

Risk management parameters should be reviewed weekly for regular market conditions and daily during high-volatility periods. This includes assessing position sizes, stop-loss levels, and overall exposure. Monthly performance reviews help in adjusting long-term risk strategies and improving trading efficiency.

What's the recommended position size for trading this pattern?

The pattern shows higher reliability in Malaysian blue-chip stocks and major forex pairs involving the Malaysian Ringgit.