Introduction

The Malaysian Forex trading landscape continues to evolve rapidly, with traders seeking sophisticated yet reliable technical analysis methods. Among these methods, Pinbar pattern analysis has emerged as a cornerstone strategy for many successful traders. Understanding how to properly identify and trade Pinbar patterns can significantly improve your trading results in the Malaysian Forex market.

Understanding Pinbar Fundamentals

A Pinbar, derived from the term “Price Action Bar,” represents a specific candlestick formation that signals potential market reversals. Malaysian traders particularly value this pattern for its clarity and reliability in indicating market sentiment shifts. The pattern’s distinctive appearance, characterized by a small body and a long wick, makes it easily identifiable even for novice traders. Market psychology plays a crucial role in forming these patterns, as they represent a strong rejection of certain price levels. Understanding the underlying market dynamics helps traders make more informed decisions based on these formations.

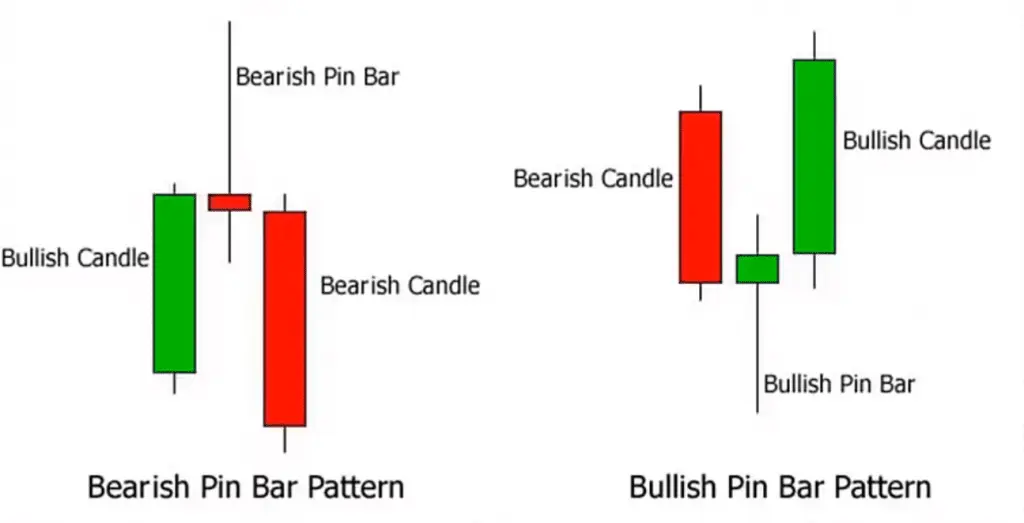

Essential Types of Pinbar Patterns

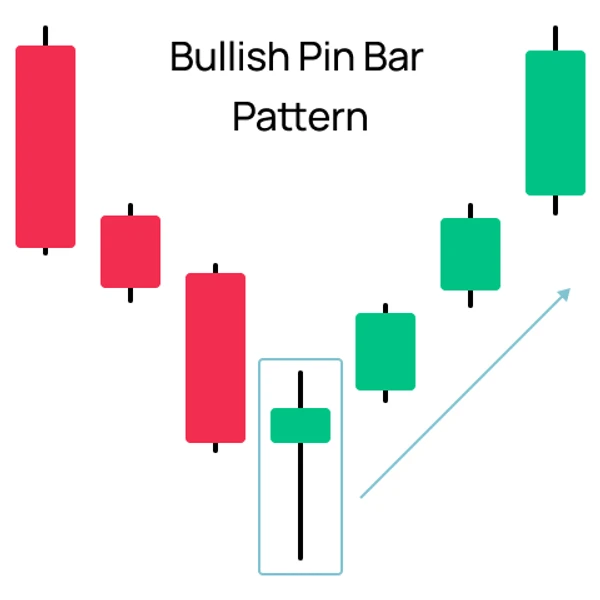

Classic Bullish Pinbar Formation:

- Forms at market bottoms

- Long lower wick (rejection tail)

- Small body near the high

- Minimum 2:1 wick-to-body ratio

- Strong reversal indication

- Appears after downtrends

- Higher success rate at support levels

Standard Bearish Pinbar Features:

- Develops at market tops

- Extended upper wick

- Compact body near the low

- Clear rejection of higher prices

- Reversal signal strength

- Common at resistance zones

- Often preceded by uptrends

| Pattern Type | Success Rate | Best Timeframe | Risk-Reward |

| Bullish Trend | 65-75% | H4/Daily | 1:2 |

| Bearish Trend | 60-70% | H4/Daily | 1:2.5 |

| Range Bound | 55-65% | H1/H4 | 1:1.5 |

Advanced Trading Techniques

Technical Integration Methods:- Moving Average Confluence

- RSI Divergence Confirmation

- Volume Analysis Support

- Trend Line Integration

- Support/Resistance Validation

Risk Management Framework

Professional traders in Malaysia implement strict risk management rules when trading Pinbar patterns:

Position Sizing Guidelines:

- Maximum 2% risk per trade

- Scaled entries for larger positions

- Account balance consideration

- Market volatility adjustment

- Currency pair specifics

- Time-based position scaling

- Risk exposure monitoring

Table 2: Position Sizing Matrix

| Account Size | Max Risk | Typical Position | Stop Range |

| $5,000 | $100 | 0.1 lot | 50-100 pips |

| $10,000 | $200 | 0.2 lot | 40-80 pips |

| $25,000 | $500 | 0.5 lot | 30-60 pips |

Market Context Analysis

Understanding market context is crucial for successful Pinbar trading:

Trend Analysis Requirements:

- Multiple timeframe confirmation

- Trend strength evaluation

- Support/resistance levels

- Market structure assessment

- Volume profile analysis

- Previous swing points

- Pattern frequency study

Implementation Strategy

Practical Application Steps:

- Pattern Identification

- Context Validation

- Entry Timing

- Stop Loss Placement

- Take Profit Planning

Table 3: Trading Implementation Guide

| Step | Action | Validation |

| Scan | Find Pinbars | Multiple timeframes |

| Analyze | Check context | Technical indicators |

| Plan | Set entry/exit | Risk management |

Common Trading Scenarios

Market Condition Applications:

- Trending Markets

- Range-Bound Markets

- Breakout Scenarios

- Reversal Patterns

- Continuation Setups

FAQ Section Additional Details

What's the minimum account size for Pinbar trading?

While you can start with $1,000, a recommended minimum of $5,000 provides better position sizing flexibility.

How long should I wait before entering a Pinbar trade?

Wait for the candlestick to close and confirm the pattern formation, typically one to two candles.

Can Pinbar patterns fail?

Yes, like any trading strategy, Pinbar patterns can fail. Always use proper risk management and confirmation signals.

What's the best market condition for Pinbar trading?

Pinbars work best in trending markets, especially at key support and resistance levels.

Should I use indicators with Pinbar patterns?

While not necessary, combining Pinbars with technical indicators can increase trading accuracy.