Introduction to Hidden Divergence

Hidden Divergence represents a powerful technical analysis tool that helps traders identify trend continuation patterns in the Malaysian forex market. This sophisticated trading concept emerges when price action shows one direction while technical indicators display opposing movements. Understanding Hidden Divergence is crucial for Malaysian traders who want to enhance their trading strategies and improve their market analysis capabilities. The concept differs significantly from regular divergence patterns, making it a valuable tool for trend-following strategies. Technical analysts in Malaysia increasingly rely on Hidden Divergence to validate existing trends and find optimal entry points. Hidden Divergence particularly stands out in the Asian trading sessions, where market movements tend to follow established patterns. The analysis of Hidden Divergence combines price action with oscillator indicators to provide comprehensive market insights.

Types of Hidden Divergence:

Bullish Hidden Divergence

- Higher lows in price action

- Lower lows in oscillator

- Indicates uptrend continuation

- Provides buying opportunities

- Common in strong bull markets

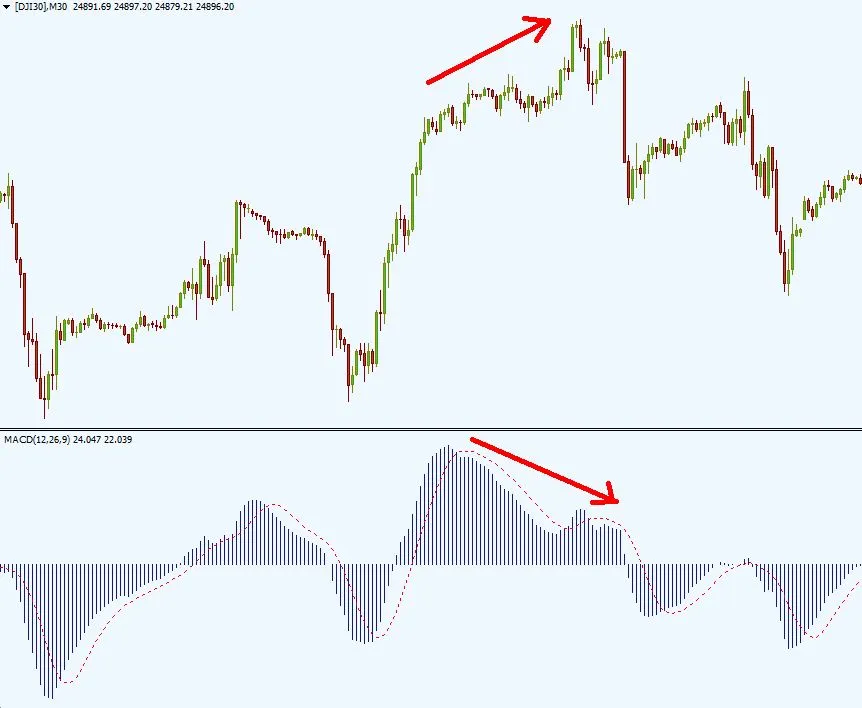

Bearish Hidden Divergence

- Lower highs in price action

- Higher highs in oscillator

- Signals downtrend continuation

- Offers selling opportunities

- Prevalent in bear markets

Key Oscillator Indicators for Hidden Divergence Analysis:

- RSI (Relative Strength Index)

- MACD (Moving Average Convergence Divergence)

- Stochastic Oscillator

- CCI (Commodity Channel Index)

- RCI (Rank Correlation Index)

Trading Implementation Strategy

Successful implementation of Hidden Divergence trading requires a systematic approach in the Malaysian market environment. Traders should first identify the prevailing market trend using higher timeframes before searching for Hidden Divergence patterns. The confirmation of these patterns typically occurs when price action maintains its trend while the oscillator shows contrary movement. Malaysian traders often combine this analysis with support and resistance levels for better entry points. Professional traders recommend using multiple timeframe analysis to validate signals. Risk management remains crucial when trading Hidden Divergence patterns. The implementation process requires patience and discipline to achieve consistent results.

Comparison Table: Hidden Divergence vs Regular Divergence

Aspect | Hidden Divergence | Regular Divergence |

Signal Type | Trend Continuation | Trend Reversal |

Price Action | Follows Trend | Against Trend |

Risk Level | Moderate | Higher |

Success Rate | Higher | Moderate |

Best Timeframes | H4 and Daily | All Timeframes |

Essential Trading Rules:

- Confirm overall trend direction

- Use multiple timeframe analysis

- Wait for pattern completion

- Apply proper risk management

- Consider market context

- Monitor indicator signals

- Track pattern reliability

FAQ Section Additional Details

What is the best timeframe for Hidden Divergence trading in Malaysia?

The H4 and Daily timeframes typically provide the most reliable signals for Malaysian traders.

Can Hidden Divergence be used with all currency pairs?

Yes, but it works best with major currency pairs that show clear trending movements.

How reliable is Hidden Divergence as a trading indicator?

When combined with other technical analysis tools, Hidden Divergence shows approximately 70-75% reliability.

What's the minimum account size recommended for Hidden Divergence trading?

A minimum of 5,000 MYR is recommended to properly implement risk management strategies.

How long does it take to master Hidden Divergence trading?

Most traders need 3-6 months of consistent practice to effectively identify and trade these patterns.