Introduction

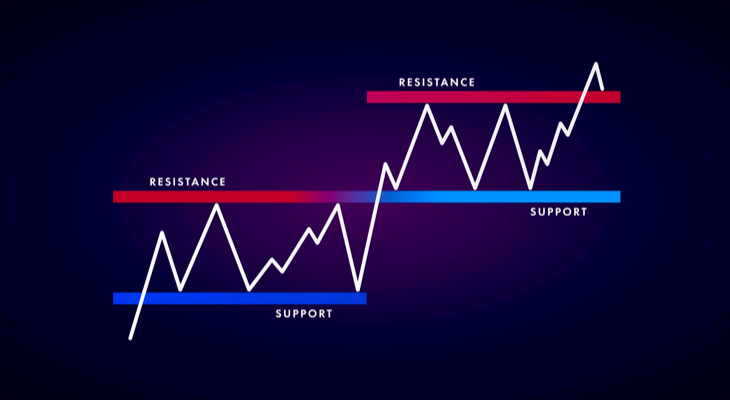

Support and resistance analysis forms the cornerstone of successful forex trading strategies in Malaysia’s dynamic market environment. This comprehensive guide explores the intricacies of support and resistance trading, providing Malaysian traders with practical insights and actionable strategies. The growing forex trading community in Malaysia has embraced these technical analysis principles to enhance their trading performance and market understanding.

Core Principles of Support and Resistance

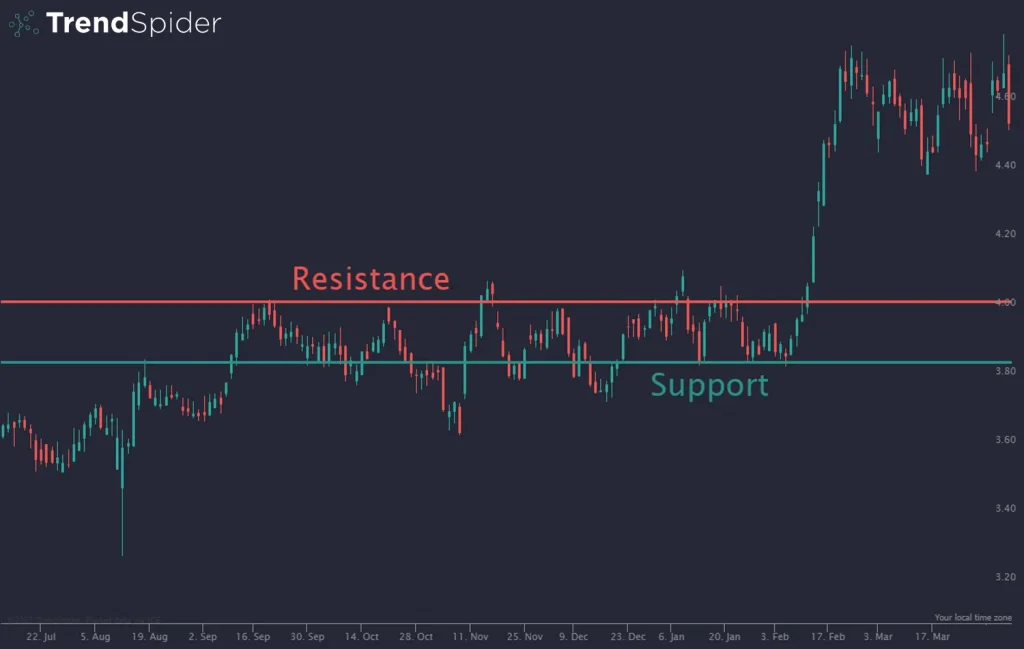

- Price Level Identification

- Market Psychology

- Volume Analysis

- Pattern Recognition

- Breakout Confirmation

- False Break Detection

- Time Frame Correlation

| Level Type | Trader Behavior | Market Impact |

| Support | Increased buying | Price bounce |

| Resistance | Enhanced selling | Price rejection |

| Breakout | FOMO trading | Trend continuation |

| False Break | Stop hunting | Price reversal |

Advanced support and resistance Implementation Strategies

Market Analysis Framework:

- Technical indicator confluence

- Price action patterns

- Volume confirmation

- Market structure analysis

- Trend direction assessment

Trading Setup Requirements:

- Clear level identification

- Multiple timeframe confirmation

- Risk-reward calculation

- Position sizing rules

- Entry trigger signals

Risk Management Matrix:

Strategy Type | Stop Loss | Take Profit | Risk Ratio |

Bounce Trade | 20-30 pips | 40-60 pips | 1:2 |

Breakout | 30-40 pips | 90-120 pips | 1:3 |

Range Trade | 15-25 pips | 30-50 pips | 1:2 |

Market Context and Trading Psychology

- Market Session Impact

- News Event Influence

- Overall Trend Direction

- Volume Profile Analysis

- Market Participant Behavior

| Session | Volatility | Volume | Best Pairs |

| Asian | Moderate | Medium | JPY, AUD |

| London | High | High | EUR, GBP |

| New York | Very High | Highest | USD pairs |

Implementation Guidelines

Practical Trading Steps:

- Chart Pattern Analysis

- Support/Resistance Mapping

- Entry Point Identification

- Stop Loss Placement

- Take Profit Setting

- Position Sizing

- Trade Management

Risk Assessment Criteria:

- Account exposure limits

- Maximum drawdown rules

- Weekly profit targets

- Daily loss limits

- Position sizing guidelines

Advanced Pattern Recognition

- Double Tops/Bottoms

- Head and Shoulders

- Triangle Formations

- Channel Patterns

- Flag Patterns

| Pattern Type | Reliability | Win Rate | Best Timeframe |

| Double Bottom | High | 75% | H4/Daily |

| Head & Shoulders | Medium | 65% | Daily |

| Triangle | High | 70% | H4 |

Conclusion:

Success in support and resistance trading requires a disciplined approach combining technical analysis, risk management, and psychological preparedness. Malaysian traders can benefit from these strategies by maintaining consistency in their approach and continuously refining their trading skills. Remember that support and resistance trading is not just about identifying levels but understanding the market context and managing risks effectively.

FAQ Section

How do you identify strong support and resistance levels?

Look for multiple price touches, high volume reactions, and clear price rejection patterns.

What's the minimum timeframe for reliable support and resistance trading?

The 4-hour timeframe and above provide the most reliable signals for support and resistance trading.

How many support/resistance levels should I monitor?

Focus on 3-4 major levels to maintain clarity in your analysis.

What's the best risk-reward ratio for support/resistance trades?

Aim for a minimum 1:2 risk-reward ratio, preferably 1:3 for breakout trades.

How do you handle false breakouts?

Wait for confirmation candles and use tight stop losses when trading potential breakouts.