Understanding GBP/JPY Trading Dynamics

The British Pound to Japanese Yen currency pair represents one of the most sophisticated trading instruments in the foreign exchange market. Malaysian traders have increasingly focused on determining when GBP/JPY will decline, as this knowledge forms the foundation of successful trading strategies. The relationship between these two major economies creates unique market conditions that experienced traders can leverage for potential profit opportunities. Understanding the intricate dynamics of this currency pair requires comprehensive knowledge of both British and Japanese economic factors. Market participants must also consider global economic conditions that influence these major currencies. Through careful analysis and strategic planning, traders can identify potential entry and exit points in the market.

Fundamental Market Structure

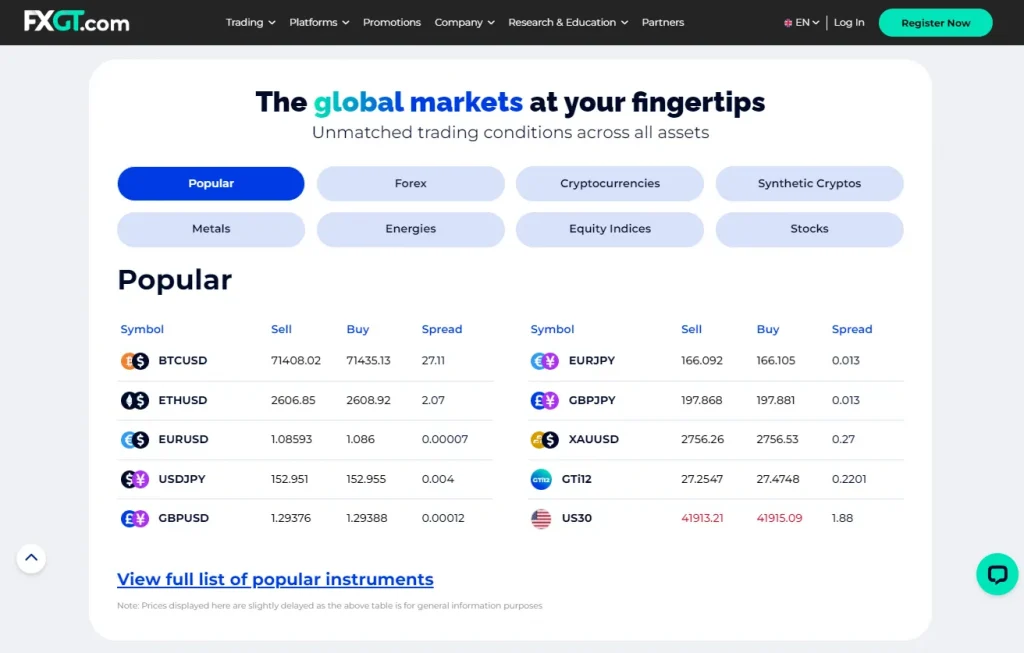

The GBP/JPY pair operates within a complex market structure that reflects the economic conditions of both nations. Trading volumes typically peak during specific market hours, particularly when London and Tokyo sessions overlap. The Bank of England and Bank of Japan’s monetary policies significantly influence price movements. Recent market data shows increasing participation from institutional investors, which has enhanced market liquidity and trading opportunities. Malaysian traders benefit from their strategic timezone position, allowing them to access multiple trading sessions effectively.

Key Trading Characteristics

Market Position and Liquidity

- Fourth largest trading volume globally

- High market depth and liquidity

- Strong institutional participation

- Consistent trading volume

- Regular market maker support

- Competitive spread conditions

- Multiple trading session access

Technical Trading Elements

- Enhanced price volatility patterns

- Clear technical formation structures

- Strong indicator responsiveness

- Predictable trading sessions

- European market correlation

- Asian session influence

- Trend continuation patterns

Historical Trading Volume Analysis

| Currency | 2020 | 2021 | 2022 | 2023 |

| USD | 44.1% | 44.2% | 44.2% | 44.3% |

| EUR | 16.1% | 15.7% | 15.3% | 15.4% |

| JPY | 8.5% | 8.4% | 8.3% | 8.4% |

| GBP | 6.4% | 6.4% | 6.5% | 6.6% |

Advanced Market Analysis Techniques

Understanding when GBP/JPY will decline requires sophisticated analysis incorporating multiple factors. Professional traders in Malaysia typically consider various elements when making trading decisions. The economic calendar plays a crucial role in determining potential price movements. Market sentiment indicators provide additional insight into possible trend reversals. Technical analysis tools help identify specific entry and exit points. Fundamental analysis supports long-term trading strategies and market direction prediction.

Economic Indicators to Monitor

Primary Market Movers

- Central bank interest rate decisions

- Monetary policy statements

- Inflation rate reports

- GDP growth statistics

- Employment data releases

- Trade balance figures

- Manufacturing PMI data

Secondary Market Influences

- Political developments

- Global market sentiment

- Commodity price movements

- Related currency pairs

- Market risk appetite

- Technical breakout levels

- Volume analysis patterns

Trading Session Analysis

| Session Type | Malaysian Time | Activity Level | Price Movement |

| London Open | 15:00-23:00 | Very High | Strong |

| Tokyo Open | 07:00-15:00 | High | Moderate |

| Overlap | 15:00-16:00 | Highest | Very Strong |

| Sydney Open | 05:00-13:00 | Moderate | Light |

Risk Management Framework

Professional trading requires comprehensive risk management strategies. Malaysian traders must implement strict risk control measures to protect their trading capital. Position sizing plays a crucial role in long-term trading success. Stop-loss orders help limit potential losses during adverse market movements. Take-profit levels should align with overall risk-reward ratios. Regular portfolio review ensures strategy effectiveness.

Essential Risk Controls

Position Management

- Maximum risk per trade calculation

- Strategic stop-loss placement

- Calculated take-profit levels

- Account balance consideration

- Appropriate leverage usage

- Position scaling methods

- Risk-reward ratio analysis

FAQ

What are the optimal trading hours for GBP/JPY in Malaysia?

The most advantageous trading period occurs during the London session (15:00-23:00 Malaysian time) when market liquidity reaches its peak and price movements are most significant.

Which factors typically trigger GBP/JPY decline?

Major catalysts include UK interest rate reductions, negative economic data releases, risk-off market sentiment, and changes in Japanese monetary policy direction.

How does GBP/JPY volatility compare to other major pairs?

GBP/JPY demonstrates higher volatility than most major currency pairs, offering increased trading opportunities while requiring more sophisticated risk management strategies.

Which technical indicators prove most effective for GBP/JPY analysis?

Experienced traders often rely on moving averages, Relative Strength Index (RSI), and Fibonacci retracement levels for analyzing GBP/JPY price movements.

How do global economic events impact GBP/JPY trading?

Global economic events, particularly those affecting UK-EU relations, international trade policies, and central bank decisions, can create significant price fluctuations in the GBP/JPY pair.