High Leverage Forex Trading: A Comprehensive Guide for Malaysian Traders

In today’s dynamic financial markets, high leverage forex trading has become increasingly popular among Malaysian traders seeking to maximize their potential returns. Understanding the fundamentals of leverage trading is crucial for success in the forex market. High leverage forex trading allows traders to control larger positions with a smaller initial capital investment, making it an attractive option for those looking to optimize their trading strategy. The Malaysian forex market offers unique opportunities for traders who understand how to properly utilize leverage while managing associated risks effectively. Foreign exchange trading requires careful consideration of market conditions, economic indicators, and proper risk management techniques to achieve consistent results.

Understanding High Leverage Trading Basics

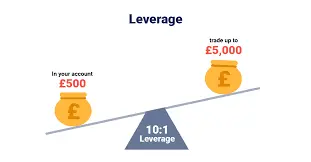

High leverage forex trading is a sophisticated trading approach that enables traders to control larger market positions with minimal capital investment. The concept of leverage works by borrowing capital from your broker to increase your trading position size beyond your actual account balance. Malaysian traders can access leverage ratios up to 1:1000 through international forex brokers, although it’s essential to understand that higher leverage also means increased risk exposure. Proper risk management becomes crucial when dealing with leveraged positions to protect your trading capital. The forex market operates 24 hours a day, five days a week, providing ample opportunities for Malaysian traders to implement their strategies.

Key Components of High Leverage Trading:

- Margin requirements

- Risk management tools

- Position sizing

- Stop-loss placement

- Take-profit levels

- Leverage ratios

- Account balance management

Risk Management Strategies

Risk Management Comparison Table:

| Strategy Type | Risk Level | Recommended Leverage | Suitable For |

| Conservative | Low | 1:50 – 1:100 | Beginners |

| Moderate | Medium | 1:200 – 1:500 | Intermediate |

| Aggressive | High | 1:500 – 1:1000 | Advanced |

Advanced Trading Techniques

Professional traders in Malaysia employ various strategies to maximize their potential returns while minimizing risks. Scalping strategy involves making multiple trades throughout the day with small profit targets. Day trading focuses on completing all trades within a single trading session. Swing trading takes advantage of price movements over several days or weeks. Position trading involves holding trades for extended periods based on fundamental analysis and long-term market trends.

Effective Trading Methods:

- Technical analysis implementation

- Fundamental analysis integration

- Price action trading

- Trend following strategies

- Counter-trend trading

- Breakout trading

- Range trading techniques

Market Analysis Tools

Essential Trading Tools Matrix:

| Tool Category | Purpose | Application |

| Technical Indicators | Price Analysis | Entry/Exit Signals |

| Economic Calendar | News Trading | Market Timing |

| Chart Patterns | Price Prediction | Strategy Development |

Common Mistakes to Avoid

Malaysian traders should be aware of common pitfalls when engaging in high leverage forex trading. Over-leveraging accounts can lead to quick account depletion. Emotional trading often results in poor decision-making. Lack of proper risk management can cause significant losses. Trading without a clear strategy reduces success probability. Ignoring market news and economic indicators can lead to unexpected losses. Not maintaining proper position sizing can result in overexposure. Failing to use stop-loss orders increases risk substantially.

Key Points to Remember:

- Always use stop-loss orders

- Maintain proper position sizing

- Follow your trading plan

- Control emotions while trading

- Monitor economic calendar

- Keep leverage levels manageable

- Document all trades

FAQ

What is the recommended starting leverage for new traders in Malaysia?

For beginners, it’s recommended to start with lower leverage ratios of 1:50 to 1:100 until developing proper risk management skills.

How does high leverage forex trading affect profit potential?

Higher leverage can amplify both profits and losses, allowing traders to control larger positions with smaller capital investment.

What are the main risks of high leverage trading?

The primary risks include increased potential for losses, margin calls, and account depletion if proper risk management isn’t implemented.

Can Malaysian traders access international forex brokers?

Yes, Malaysian traders can access international forex brokers offering high leverage options, subject to local regulations.

What is the most important aspect of high leverage trading?

Risk management is the most crucial aspect, including proper position sizing and stop-loss placement to protect trading capital.