Introduction

The Malaysian forex market has witnessed a growing interest in sophisticated trading strategies, with FX Pyramiding emerging as a prominent method among experienced traders. This approach involves systematically increasing position sizes as profits accumulate, allowing traders to maximize potential gains during strong trend movements. Understanding the intricacies of FX Pyramiding can significantly enhance trading performance when implemented correctly.

Understanding FX Pyramiding Fundamentals

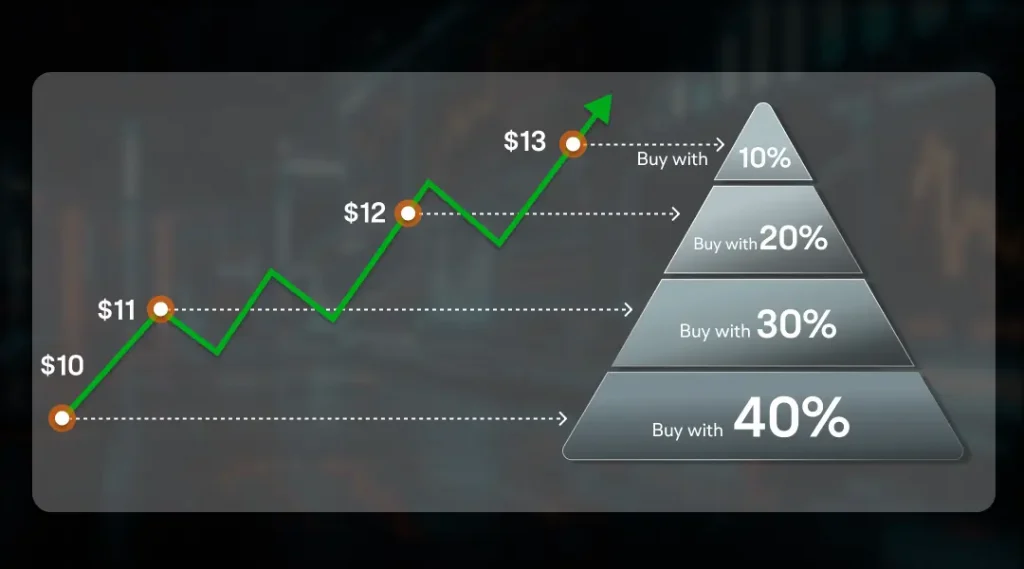

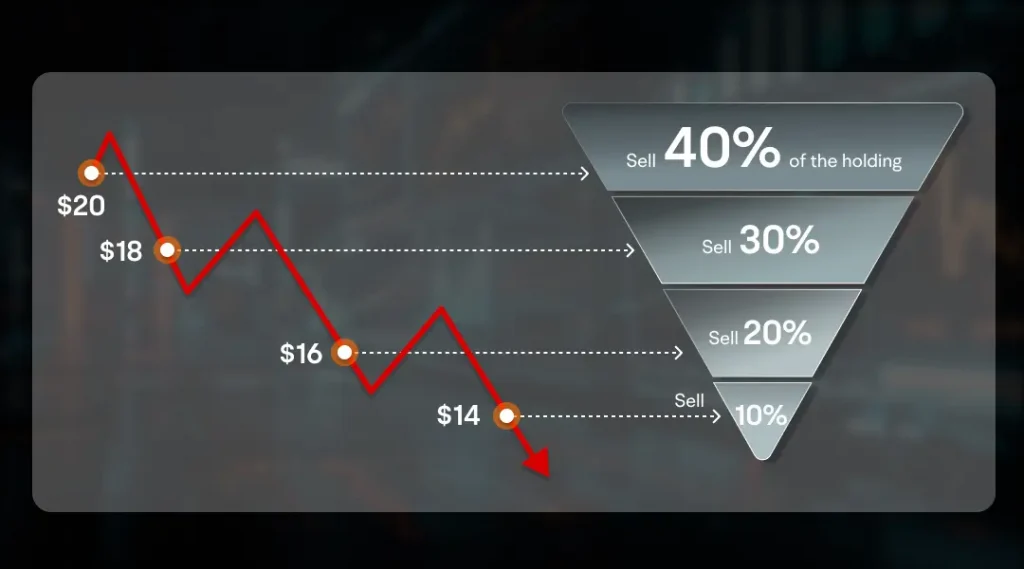

FX Pyramiding represents a strategic trading approach where traders gradually build larger positions as their initial trade moves in their favor. This method differs from conventional trading strategies by leveraging existing profits to increase exposure to favorable market movements. The strategy requires careful position sizing and risk management to be successful.

Types of FX Pyramiding:

Scale-down Pyramiding

- Decreasing position sizes with each additional entry

- Lower risk exposure on subsequent trades

- Conservative approach suitable for beginners

- Maintains profit potential while limiting risk

Reverse Pyramiding

- Increasing position sizes with each new entry

- Higher potential returns but increased risk

- Requires strong trend confirmation

- Best suited for experienced traders

Equal Position Pyramiding

- Consistent position sizes across all entries

- Balanced risk-reward approach

- Easier position management

- Moderate risk exposure

Key Benefits of FX Pyramiding

| Method | Risk Level | Profit Potential | Complexity |

| Scale-down | Low | Moderate | Low |

| Reverse | High | Very High | High |

| Equal | Medium | High | Medium |

Risk Management Considerations

Essential risk management principles for FX Pyramiding:Position Sizing Rules

- Never exceed 2% risk per initial entry

- Scale subsequent positions based on profits

- Maintain adequate margin requirements

- Monitor total exposure carefully

Entry Criteria

- Strong trend confirmation

- Clear support/resistance levels

- Volume confirmation

- Technical indicator alignment

- Price action patterns

| Aspect | Recommendation | Purpose |

| Initial Risk | 2% maximum | Capital preservation |

| Stop Loss | Trailing stops | Lock in profits |

| Position Size | Decreasing scale | Risk control |

Implementation Strategy

Steps for successful FX Pyramiding:

- Market Analysis

- Initial Position Entry

- Profit Target Setting

- Position Scale Rules

- Exit Strategy Development

Table 3: Implementation Framework

Phase | Action | Timing |

Entry | Base position | Trend start |

Scale | Add positions | During trend |

Exit | Take profits | Trend end |

FAQ Section

What is the minimum capital required for FX Pyramiding?

While there’s no strict minimum, it’s recommended to start with at least $5,000 to properly implement position scaling and risk management.

How does FX Pyramiding differ from averaging down?

FX Pyramiding adds positions to winning trades, while averaging down adds to losing positions. This fundamental difference makes pyramiding generally safer.

Can FX Pyramiding be used in ranging markets?

No, FX Pyramiding is specifically designed for trending markets and should be avoided during ranging conditions.

What's the ideal timeframe for FX Pyramiding?

Daily and 4-hour charts are most suitable as they provide clearer trend identification and fewer false signals.

How many positions should be added in a pyramid structure?

Most successful traders limit their pyramid to 3-4 positions to maintain manageable risk levels and avoid overexposure.