Introduction

The Parabolic SAR (Stop and Reverse) indicator represents a powerful technical analysis tool widely used in forex trading across Malaysian markets. This sophisticated indicator, developed by J. Welles Wilder, helps traders identify potential trend reversals and establish optimal entry and exit points. Understanding how to effectively utilize Parabolic SAR can significantly enhance trading performance and decision-making capabilities in the dynamic forex market.

Understanding Parabolic SAR

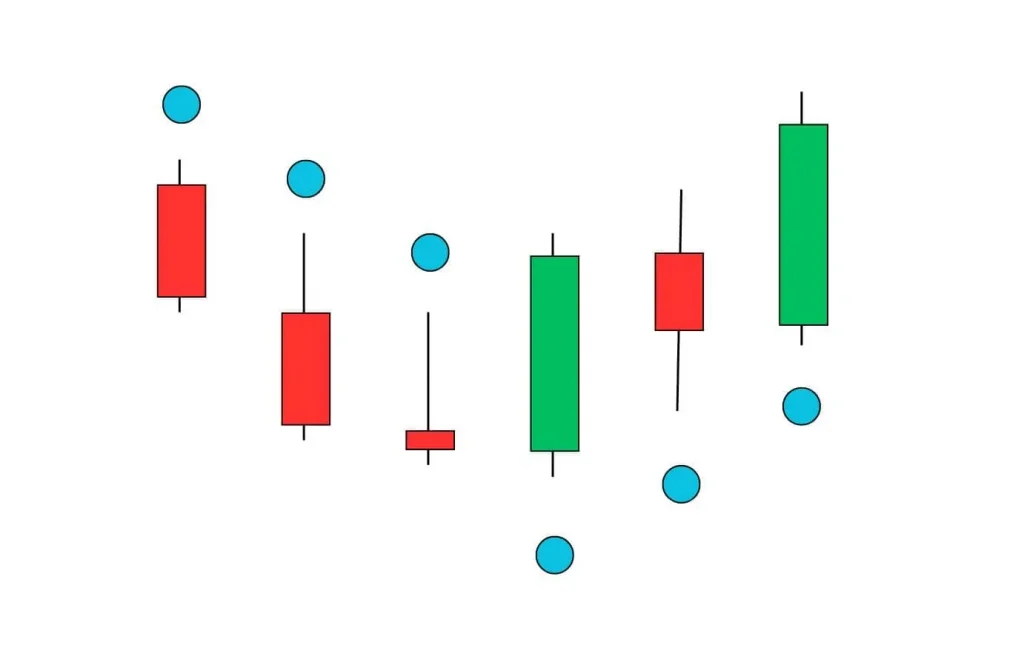

The fundamental concept behind Parabolic SAR revolves around plotting points on a chart that indicate potential reversal zones. These points create a pattern resembling a parabolic curve, hence the name. In Malaysian forex markets, traders rely on this indicator to determine trend direction, momentum, and potential reversal points with remarkable accuracy.

Key Components of Parabolic SAR:

- Acceleration Factor (AF)

- Extreme Point (EP)

- Stop and Reverse Points

- Trend Direction Indicators

- Momentum Signals

Technical Parameters:

[Table 1: Parabolic SAR Settings]

Parameter | Default Value | Range |

AF Start | 0.02 | 0.01-0.03 |

AF Step | 0.02 | 0.01-0.03 |

AF Maximum | 0.20 | 0.18-0.22 |

Trading Strategy Implementation

- Bullish Entry Points

- Bearish Entry Points

- Trend Confirmation

- Volume Analysis

- Support/Resistance Levels

| Account Size | Risk per Trade | Stop Loss |

| $1,000 | 1% | 20 pips |

| $5,000 | 2% | 30 pips |

| $10,000 | 3% | 40 pips |

Advanced Trading Techniques

To enhance trading success with Parabolic SAR, consider these advanced strategies:

- Multiple Timeframe Analysis

- Trend Strength Confirmation

- Support/Resistance Integration

- Volume Correlation

- Price Action Patterns

Common Mistakes to Avoid:

- Overtrading during ranging markets

- Ignoring other technical indicators

- Poor position sizing

- Lack of stop-loss orders

- Emotional trading decisions

| Aspect | Beginner | Intermediate | Advanced |

| Win Rate | 40-50% | 50-60% | 60-70% |

| Risk:Reward | 1:1.5 | 1:2 | 1:3 |

| Monthly Return | 5-10% | 10-15% | 15-20% |

FAQ Section Additional Details

Is Parabolic SAR suitable for scalping?

While possible, Parabolic SAR is more effective for swing trading due to its lag in fast-moving markets.

What's the ideal timeframe for Parabolic SAR?

The H4 and daily timeframes typically provide the most reliable signals

Can Parabolic SAR be used with cryptocurrency trading?

Yes, it works well with any tradable asset, including cryptocurrencies.

How often should I adjust Parabolic SAR settings?

Default settings work well in most cases, but optimization may be needed every 3-6 months.

What's the best companion indicator for Parabolic SAR?

Moving averages and RSI complement Parabolic SAR effectively for trend confirmation.