Comprehensive MT4 ZigZag Trading Analysis

Originally introduced by FXGT, the MT4 ZigZag indicator has revolutionized technical analysis in the Malaysian trading landscape. This sophisticated tool connects significant price points on trading charts, creating a clear visual representation of market movements. The indicator’s primary function is to eliminate market noise by focusing on meaningful price swings. Malaysian traders particularly appreciate its ability to highlight genuine market trends while filtering out minor fluctuations. The tool’s adaptive nature makes it especially valuable in volatile market conditions. Professional traders often combine ZigZag analysis with other technical indicators for enhanced accuracy. The indicator’s mathematical algorithm continuously updates to reflect the most current market conditions.

Core Technical Components

- Algorithm Fundamentals

- Price Swing Calculation

- Trend Line Generation

- Reversal Point Identification

- Signal Confirmation Methods

| Market Type | Depth Setting | Deviation Value | Backstep Range |

| Forex Majors | 12-15 | 5-7 | 3-4 |

| Forex Minors | 15-18 | 6-8 | 4-5 |

| Exotic Pairs | 18-24 | 8-10 | 5-6 |

Strategic Implementation Framework

- Market Analysis Methodology

- Entry Point Optimization

- Risk Control Systems

- Trend Confirmation Techniques

- Exit Strategy Development

Advanced Trading Applications

Professional traders utilize these advanced applications: Table 2: Trading Strategy Matrix| Strategy Type | Timeframe | Risk Level | Success Rate |

| Scalping | 1M-5M | High | 65-75% |

| Day Trading | 15M-1H | Medium | 70-80% |

| Swing Trading | 4H-1D | Low | 75-85% |

Market Condition Analysis

Understanding market phases is crucial:

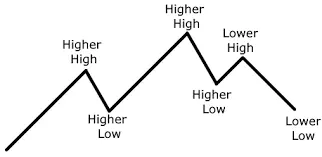

Trend Identification

- Strong Uptrend

- Weak Uptrend

- Sideways Movement

- Weak Downtrend

- Strong Downtrend

Volume Analysis

- High Volume Trends

- Low Volume Consolidation

- Breakout Volumes

- Reversal Volumes

Risk Management Integration

| Position Size | Stop Loss | Take Profit | Risk Ratio |

| Micro | 20-30 pips | 40-60 pips | 1:2 |

| Mini | 30-50 pips | 60-100 pips | 1:2 |

| Standard | 50-70 pips | 100-140 pips | 1:2 |

Advanced Technical Integration

The MT4 ZigZag indicator works best when combined with:

- Momentum Indicators

- Volume Analysis Tools

- Price Action Patterns

- Trend Following Indicators

- Volatility Measures

Frequently Asked Questions

How does MT4 ZigZag handle volatile market conditions?

The indicator adapts dynamically to market volatility through its parameter settings. It automatically adjusts swing point identification based on price movement magnitude. Traders can optimize parameters for different volatility levels to maintain accuracy.

What's the optimal way to combine ZigZag with other indicators?

The most effective approach is to use ZigZag with trend-following indicators like Moving Averages. Add momentum indicators such as RSI or MACD for confirmation. This creates a comprehensive trading system with multiple confirmation points.

How frequently should traders update their ZigZag strategies?

Strategy updates should occur monthly or when market conditions significantly change. Regular backtesting of parameters ensures optimal performance. Market evolution requires constant strategy refinement.

Can ZigZag identify potential reversal points?

ZigZag effectively highlights potential reversal points through swing high and low patterns. Combine with support/resistance levels for better accuracy. The indicator’s historical pattern analysis helps predict future reversals.

What role does timeframe analysis play in ZigZag trading?

Multiple timeframe analysis is crucial for comprehensive market understanding. Higher timeframes provide strategic direction while lower timeframes optimize entry points. The combination of timeframes increases trading accuracy significantly.